For those exploring investment opportunities, Trading212 offers a straightforward entry point. This platform allows you to trade shares, ETFs, and other assets with ease. What makes it stand out? A compelling offer: a complimentary fractional share worth up to £100 when you join. It’s designed to help UK investors kickstart their portfolios without hefty upfront costs.

Getting started is simple. First, sign up using a referral link or app-based promo code. Next, open an Invest or Stocks ISA account – both options cater to different financial goals. You’ll only need a minimum deposit of £1 to activate the offer. Once your account is verified, the platform processes your free share within three business days.

Security remains a priority. Trading212 operates under FCA regulation, ensuring your funds and data meet strict safeguards. This combination of accessibility and compliance makes it appealing for newcomers and seasoned traders alike.

Ready to take the next step? The sections below break down everything from account setup to maximising your investment potential. Let’s dive into how you can leverage this opportunity effectively.

Comprehensive Overview of Trading212

Investors in the UK increasingly turn to this platform for its adaptable approach to financial markets. Whether you’re building a long-term portfolio or exploring short-term opportunities, the service combines intuitive design with powerful tools.

Platform Features and Capabilities

The digital interface simplifies complex processes. You can trade fractional slices of major company stocks, ETFs, or forex pairs with a few taps. Key features include:

- Zero commission on equity trades

- Real-time market data and price alerts

- Customisable watchlists for tracking preferred assets

Desktop and mobile apps mirror each other’s functionality, letting you manage positions seamlessly across devices. Over 10,000 instruments are available, from US tech giants to niche commodities.

Regulation, Security and Trust

Authorised by the Financial Conduct Authority (FCA), the platform adheres to strict operational standards. Client funds sit in segregated accounts, protected under the Financial Services Compensation Scheme (FSCS) up to £85,000.

Transparent fee structures eliminate surprises. Spreads on forex and CFD trades remain competitive, while stock purchases incur no hidden charges. This clarity makes it easier to calculate potential returns.

How to Claim Your Trading212 Free Share

Securing your complimentary stock reward requires following a few straightforward steps. This guide walks you through the activation process, eligibility rules, and key timelines to ensure you receive your allocation efficiently.

Using Your Referral Link or Promo Code

Begin by signing up through a referral link or downloading the app. During registration, navigate to the ‘Offers’ section and input your chosen promotion code. This activates your eligibility for the reward.

After creating your account, deposit at least £1 into your chosen portfolio. Transfers typically process within minutes via debit card or bank transfer. Once confirmed, the platform assigns your fractional stock within three working days.

Minimum Deposit and Eligibility Criteria

Your account must meet these conditions to qualify:

| Criteria | Details | Notes |

|---|---|---|

| Age & Residency | 18+, UK resident | Proof of address required |

| Deposit | £1 minimum | Non-refundable |

| Verification | Completed within 30 days | Delays forfeit the offer |

Stocks allocated range from £8 to £100 in value. You can sell them immediately or monitor their performance in your portfolio. Remember to review terms regarding regional restrictions or account inactivity penalties.

Trading212 Free Share – Supported Assets and Trading Opportunities

Diversifying your portfolio starts with accessing varied markets. Modern platforms provide tools to invest in everything from blue-chip equities to niche derivatives, all through a single interface.

Stocks, ETFs and Fractional Trading

Fractional ownership lets you participate in high-value companies without needing full share prices. Imagine owning a slice of firms like Apple or Tesla for as little as £5. This approach lowers entry barriers while maintaining exposure to market movements.

| Feature | Traditional Trading | Fractional Trading |

|---|---|---|

| Minimum Investment | Full share price | From £1 |

| Diversification Speed | Limited by capital | Instant across sectors |

| Liquidity Management | Requires larger sums | Flexible allocation |

Exchange-traded funds (ETFs) bundle multiple assets into one tradeable unit. They’re ideal for spreading risk across industries or regions. Combine these with fractional shares to build a balanced portfolio efficiently.

Forex, CFDs and Other Instruments

Currency pairs and contracts for difference (CFDs) cater to different strategies. Forex trading lets you speculate on exchange rate fluctuations, while CFDs mirror commodity prices or indices without physical ownership.

Key considerations when using these tools:

- Leverage amplifies both gains and losses

- 24/5 markets enable round-the-clock positioning

- Risk management tools like stop-loss orders are essential

These instruments complement traditional investments, letting you hedge positions or capitalise on short-term trends. Always assess your risk tolerance before engaging with leveraged products.

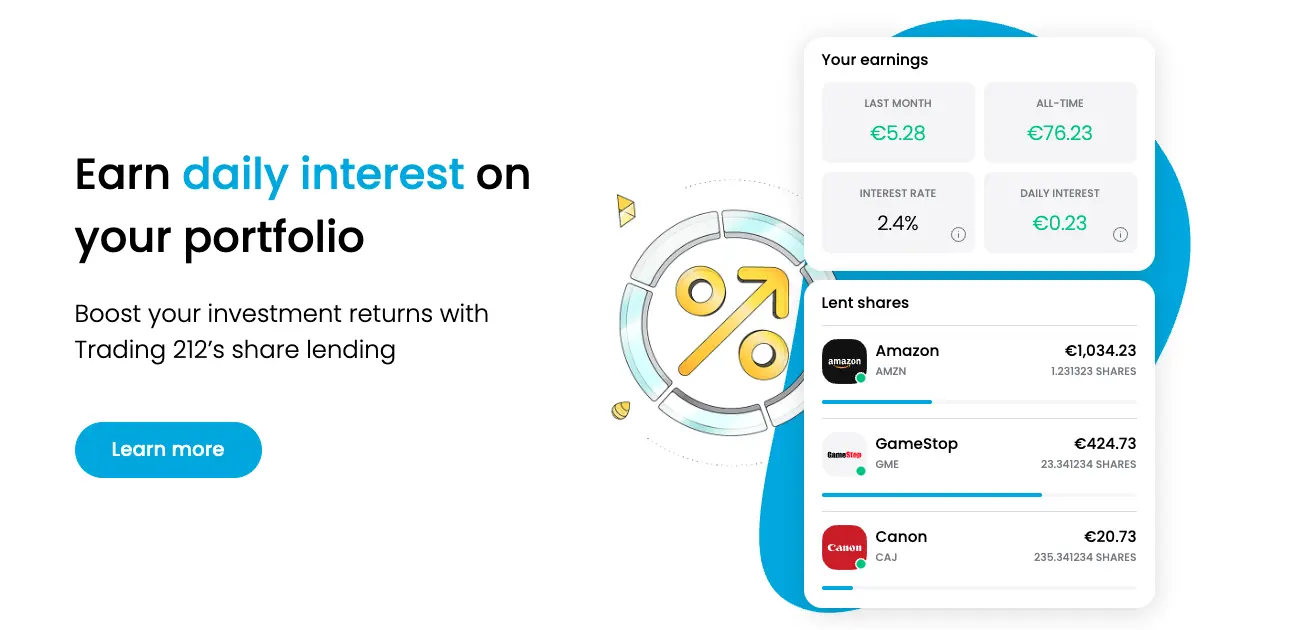

Understanding Fees and Commissions

Transparent pricing separates reliable investment platforms from the rest. While many services advertise low costs, understanding exactly where charges apply ensures you keep more of your returns. This section breaks down what ‘zero commission’ really means and highlights other potential expenses to watch.

Zero Commission Trading Explained

Zero commission means you won’t pay fees per trade when buying or selling equities. This structure benefits frequent traders, as costs don’t erode profits from small gains. The platform covers operational expenses through spreads – the difference between buy and sell prices – or premium subscription tiers.

Additional Costs and Considerations

While stock trades incur no fees, certain actions trigger charges:

| Fee Type | Traditional Platforms | Zero-Commission Services |

|---|---|---|

| Trade Commission | £5-£10 per transaction | None |

| Currency Conversion | 1-2% per trade | 0.15-0.5% markup |

| Inactivity (12+ months) | £10/month | £0 |

Free stocks credited to your account often require a 3-day holding period before selling. Withdrawals below £50 may incur a £3 fee. Always check currency rates if dealing with international assets, as conversions affect final amounts.

By prioritising transparency, the service helps you manage capital effectively. Review all terms to avoid surprises and align your strategy with the fee landscape.

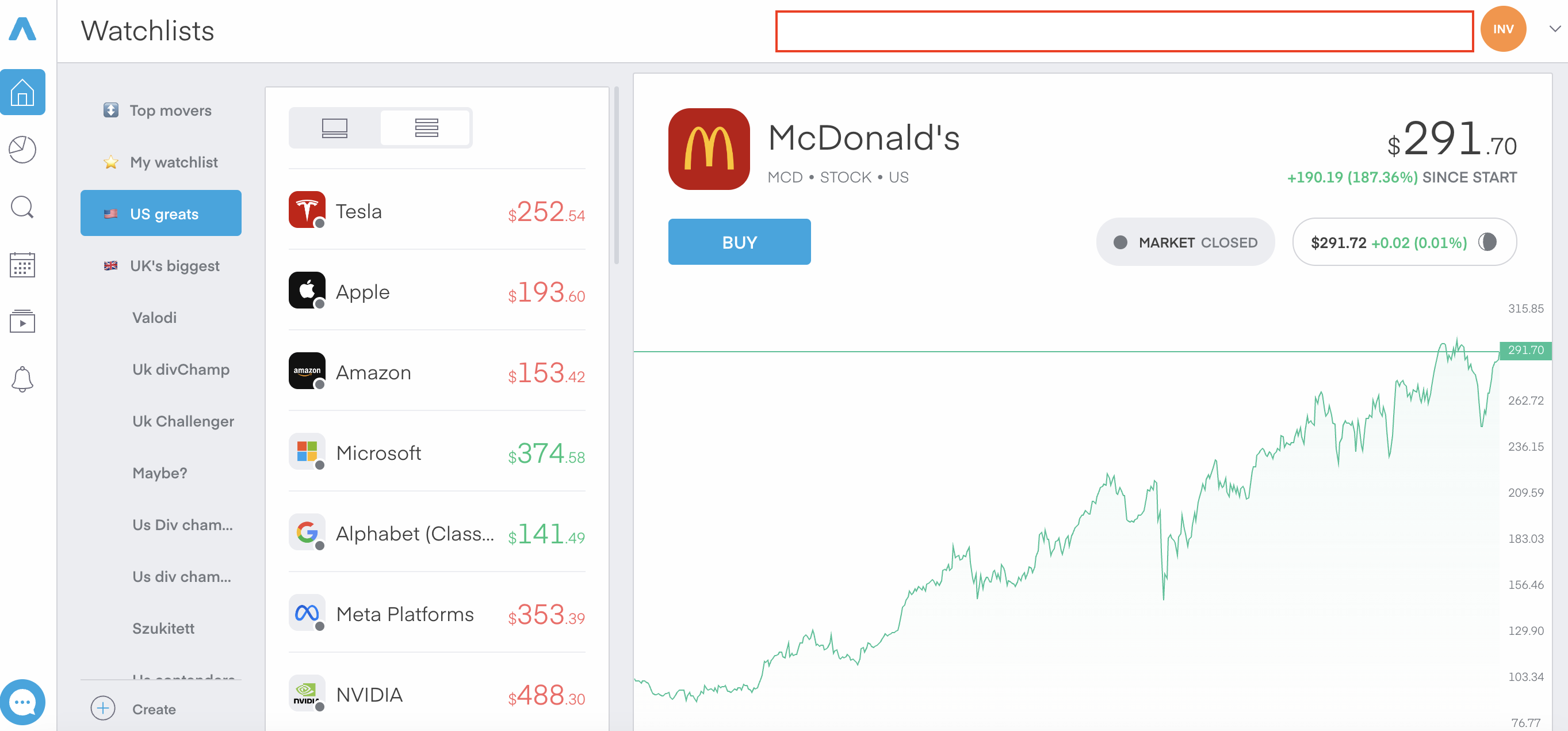

User Experience on Mobile and Web Platforms

Navigating financial markets demands tools that adapt to your lifestyle. Whether you prefer managing investments from your sofa or analysing trends at a desk, seamless functionality matters. Both platforms prioritise clarity, letting you focus on strategy rather than struggling with clunky interfaces.

Intuitive Mobile App Interface

The mobile app simplifies trading with a clean layout. Key metrics like portfolio value and market movers appear on the home screen. One-tap access to charts, orders, and watchlists keeps everything within reach.

Real-time alerts notify you of price shifts or news affecting your holdings. Customisable widgets let you track preferred stocks or indices without opening the app. This efficiency makes it ideal for adjusting positions during commutes or lunch breaks.

| Feature | Mobile App | Web Platform |

|---|---|---|

| Navigation | Gesture-based menus | Expanded toolbar options |

| Tools Available | Basic charts, quick orders | Advanced indicators, backtesting |

| Customisation | Home screen widgets | Multiple workspace layouts |

| Screen Real Estate | Optimised for 6-inch displays | Full HD chart analysis |

Web Platform Advantages for Comprehensive Trading

Desktop users gain deeper analytical capabilities. Multi-pane views let you monitor live prices, research reports, and execution windows simultaneously. Drawing tools and historical data filters support informed decisions.

Hotkeys accelerate order placement for frequent traders. The web version also integrates with third-party tools like TradingView for enhanced technical analysis. Larger screens reveal nuances in price patterns that mobiles might miss.

Both platforms sync instantly, so your watchlists and open positions update across devices. This flexibility suits investors who switch between quick checks and detailed planning. Consistent design elements reduce learning curves, helping you stay productive wherever you trade.

Trading212 free share: A Special Feature for UK Investors

Building your portfolio becomes simpler when platforms offer tangible incentives. The complimentary stock initiative stands out for UK-based users, providing immediate exposure to markets without upfront costs. Shares allocated range from £8 to £100 in value – a practical introduction to equity ownership.

Combine this with referral rewards for amplified benefits. Invite friends using your unique link, and both parties receive extra shares upon their qualifying deposit. Recent campaigns have paired these incentives with boosted Cash ISA interest rates, enhancing long-term growth potential.

Activating the offer requires minimal effort. Enter a promo code during registration and deposit just £1. This low barrier encourages newcomers to test strategies with reduced capital risk. Once claimed, you can hold the shares or reinvest proceeds into other assets.

UK-specific safeguards add appeal. FCA oversight ensures transparent terms, while segregated client funds protect your investments. Such features make this promotion more than a gimmick – it’s a strategic entry point for building diversified holdings.

By merging accessibility with regulatory rigour, the platform delivers tailored value. Whether you’re eyeing blue-chip stocks or niche ETFs, your journey starts with a risk-free stake in the market.

Pros and Cons of Trading212

Evaluating any investment service requires weighing its benefits against possible limitations. This platform combines accessible tools with market exposure, but understanding its full scope helps you make informed choices.

Key Advantages for Beginners and Experienced Traders

Zero commission trading tops the list of perks. You’ll avoid per-transaction fees on stocks and ETFs, keeping costs predictable. Fractional ownership lets you diversify with small sums – ideal for testing strategies without major commitments.

- Intuitive interface simplifies order execution

- Real-time data supports timely decisions

- Complimentary stock offers immediate portfolio growth

Users report seamless onboarding, with some earning instant returns from their promotional stocks. The FCA-regulated environment adds credibility, while 24/5 market access suits various schedules.

Potential Drawbacks and Important Risks

Account verification delays occasionally postpone access to features. Eligibility rules for bonuses require careful attention – missed deadlines or incomplete deposits forfeit rewards.

- Market volatility affects stock values unpredictably

- Currency conversion fees apply to international trades

- Limited customer support during peak hours

While leverage options exist for CFDs, they amplify potential losses. Always set stop-loss orders and review risk disclosures. Though the platform streamlines investing, capital preservation demands personal diligence.

Conclusion

Entering financial markets becomes less daunting with platforms that prioritise accessibility. The process of claiming your complimentary stock requires just three steps: sign-up, deposit £1, and await allocation within three working days. This low-barrier approach lets you test strategies without significant capital commitment.

Key advantages include commission-free equity trades and fractional ownership of high-value stocks. FCA oversight ensures your funds remain protected, while real-time tools help manage positions effectively. Remember, eligibility hinges on UK residency and completing verification promptly.

Every opportunity carries inherent risks. Market volatility affects share worth, and leveraged products amplify potential losses. However, understanding fee structures and using stop-loss orders can mitigate these challenges.

By combining regulatory security with user-friendly features, this service stands out for both newcomers and experienced traders. Approach your bonus shares as a learning tool – monitor performance, diversify holdings, and reinvest proceeds wisely. Informed decisions remain your strongest asset in building long-term wealth.