Investing in the UK doesn’t have to mean hefty fees or complicated processes. This guide explains how you can reduce costs while accessing a trusted platform’s features. Whether you’re starting your journey or looking to optimise existing strategies, understanding fee-saving opportunities is crucial.

Many platforms now offer incentives to attract users, but few combine simplicity with genuine value. One standout option provides commission-free trades alongside a free share for eligible participants. New users benefit automatically – no manual code entry required – while existing clients may apply a referral link during specific periods.

Safety remains a priority. The service is regulated by top financial authorities, ensuring your investments meet strict security standards. Its intuitive design caters to both beginners and seasoned traders, offering tools like ISAs to maximise tax efficiency.

This article breaks down each step: signing up, claiming rewards, and navigating fee structures. Real-world examples illustrate how these features work in practice. You’ll also learn about eligibility criteria and time-sensitive offers to avoid missing out.

Ready to explore how modern investing balances affordability with reliability? Let’s begin.

Trading212: A Comprehensive Overview

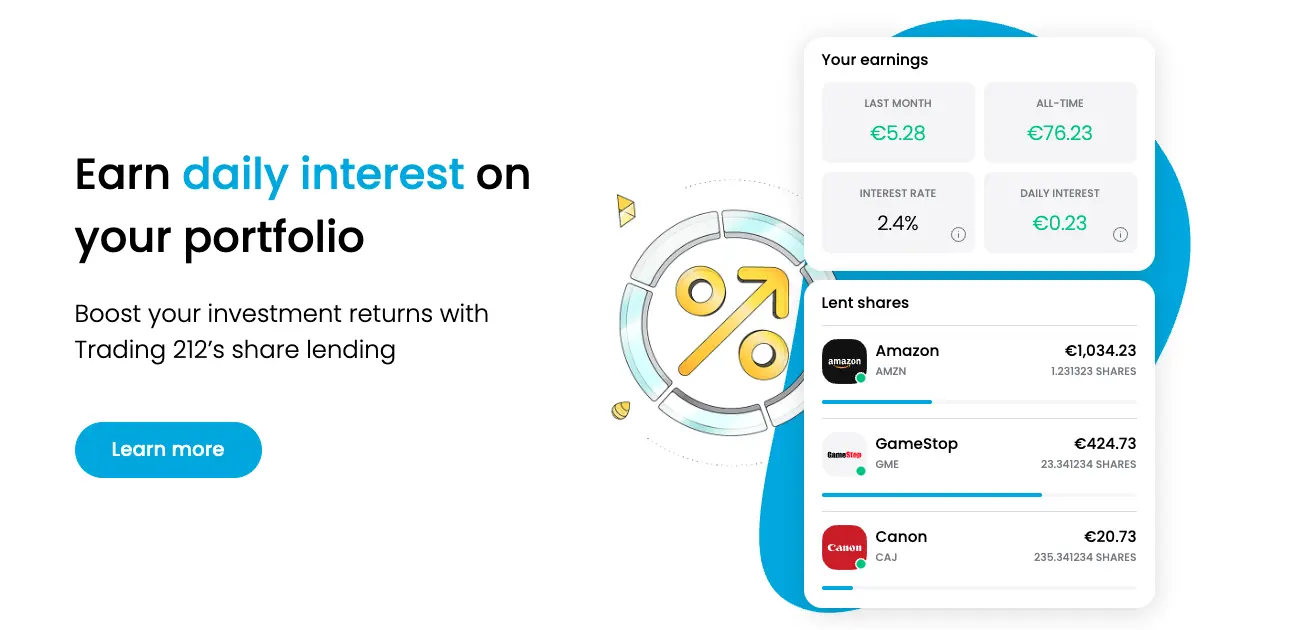

Navigating financial markets efficiently requires a blend of accessibility and reliability. This service stands out by offering commission-free trades across thousands of assets, from global stocks to forex pairs. Its fractional share feature lets you invest in high-value companies with as little as £1, ideal for diversifying smaller portfolios.

Core Offerings and Asset Diversity

You’ll find over 10,000 instruments available, including ETFs, commodities, and CFDs. Stocks from major exchanges like the NYSE and LSE are accessible alongside real-time market data. While spreads start competitively at 0.1% for forex, CFD positions incur overnight fees – a detail worth noting for active traders.

The fee structure prioritises transparency. No custody charges or hidden costs apply to standard share dealing. Deposit methods like bank transfers and cards are fee-free, though currency conversions carry a 0.15% charge. Tax-efficient options like Stocks and Shares ISAs help UK investors shield up to £20,000 annually from capital gains tax.

Trust Through Compliance and Design

Regulated by the FCA and FSCS-protected up to £85,000, your capital benefits from rigorous safeguards. Two-factor authentication and segregated client accounts add layers of security. The interface simplifies complex tasks – setting price alerts or analysing trends takes seconds on both mobile and desktop versions.

Whether you’re building long-term holdings or executing short-term strategies, this platform’s combination of low costs and regulatory oversight makes it a practical choice. These features set the stage for maximising value when paired with introductory incentives.

Utilising the Trading212 promo code for Optimised Trading Savings

Unlocking value while investing starts with understanding available incentives. These features help reduce costs and enhance returns, whether you’re starting fresh or expanding existing strategies.

Claiming Your Introductory Reward

New users automatically qualify for a free fractional share worth up to £100 when signing up through a referral link. Simply complete registration and deposit at least £1. No manual code entry is needed – the system applies rewards instantly after verifying your identity.

Sharing Benefits With Others

Invite friends using your unique referral link to earn additional fractional shares. Both parties receive this perk once their deposits clear. Existing clients can access limited-time offers like boosted Cash ISA rates by entering specific terms during promotional periods.

| User Type | Steps Required | Reward Value |

|---|---|---|

| New | Sign up + £1 deposit | Free share (up to £100) |

| Existing | Apply code during offers | Interest rate boosts |

| Referrer | Share link + successful invite | Additional fractional shares |

Quick Activation Guide

Follow these steps to secure your benefits:

- Choose a referral link or applicable offer

- Complete registration with valid ID

- Deposit the minimum required amount

- Check your account within 48 hours for rewards

Time-sensitive offers require prompt action. Always review terms regarding deposit windows and eligibility criteria to avoid missing opportunities.

Benefits, Fees and Investment Pros & Cons

Choosing the right investment platform involves balancing cost efficiency with risk management. This analysis explores key features that impact your returns, from fee transparency to asset diversity.

Fee Structure, Commissions and Supported Investments

Enjoy zero-commission trading on stocks and ETFs, with spreads starting at 0.1% for forex pairs. Over 10,000 instruments are available, including fractional shares requiring just £1 to start. CFDs attract overnight fees, while currency conversions cost 0.15%.

The Cash ISA offers a 5.07% introductory interest rate, shielding £20,000 annually from tax. Deposits face no charges, though withdrawals may take two business days. Real-time data tools help you track performance without extra costs.

Advantages, Drawbacks and Capital Risk Considerations

Key benefits include FCA regulation and an intuitive interface. However, CFD trading carries capital risk – losses can exceed deposits. The table below summarises critical factors:

| Aspect | Pros | Cons |

|---|---|---|

| Costs | No custody fees | Overnight CFD charges |

| Accessibility | Fractional shares | £1 minimum deposit |

| Security | FSCS protection | Market volatility risks |

While tax-efficient ISAs and low barriers to entry appeal to beginners, experienced traders might seek advanced charting tools. Always assess your risk tolerance against platform terms before committing funds.

Conclusion

Making informed investment decisions requires balancing value with security. The platform discussed combines commission-free trading across diverse assets with FCA-regulated safeguards, offering UK investors a streamlined way to grow their portfolios. Its intuitive design removes barriers for beginners while providing essential tools for strategic planning.

Claiming your free share worth up to £100 remains straightforward. Whether you’re new or sharing a referral link, meeting simple deposit requirements unlocks immediate benefits. Pair this with tax-efficient options like the Cash ISA, which currently offers competitive interest rates to maximise returns on sheltered savings.

While low fees and fractional shares enhance accessibility, always review terms regarding capital risk and eligibility criteria. Taking action now lets you capitalise on time-sensitive opportunities while enjoying robust financial protections.

Ready to begin? Use your unique referral link today to register and start trading with confidence. This approach ensures you secure introductory rewards while accessing a platform designed for long-term value.