Managing investments and daily spending through a single platform might sound ambitious, but one UK-focused service aims to deliver both. The debit card linked to this investment account lets you trade shares and ETFs while accessing uninvested funds for purchases. It’s designed to simplify how you handle your money without compromising financial safeguards. Trading212 card gives you all what you need.

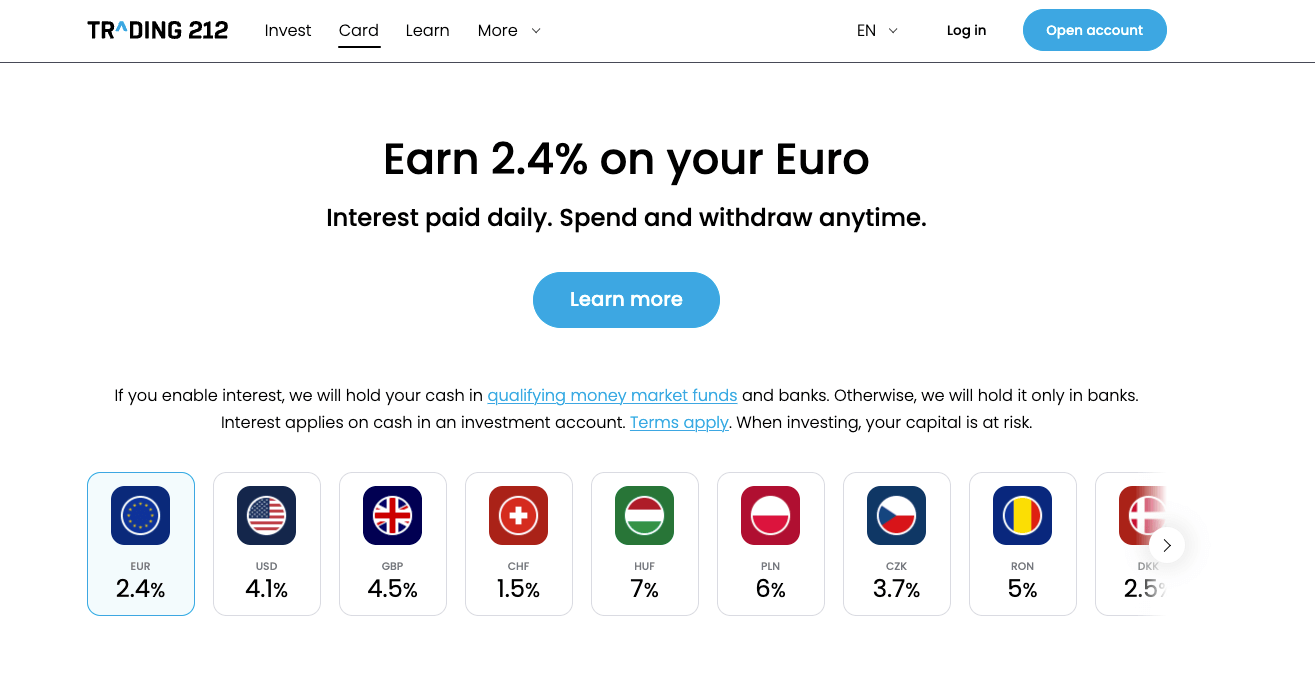

This solution combines a stocks and shares ISA with everyday banking features. Users earn 0.5% cashback on purchases, rising to 1.5% when rewards are automatically reinvested. Funds not allocated to markets receive competitive interest rates, making idle cash work harder. Both virtual and physical Mastercard options are available, complete with contactless payments and PIN security.

Financial Security Service (FSCS) protection covers deposits up to £85,000, mirroring traditional bank safeguards. The accompanying mobile app provides real-time tracking of investments and spending patterns. Whether you’re buying groceries or adjusting your portfolio, everything happens within the same ecosystem.

Our review examines how this dual-purpose account performs in practice. We’ll explore fee structures, currency support for international use, and practical benefits for active traders. You’ll also discover how the cashback scheme compares to conventional rewards cards and whether the platform justifies its growing popularity.

Overview of Trading212 as a Broker

Modern investors demand flexibility, and this platform delivers through extensive market access paired with intuitive design. It stands out by offering commission-free trades across multiple asset classes, making it attractive for both casual traders and seasoned portfolio managers.

Main Features and Supported Assets

You’ll find over 10,000 instruments available, including shares from the FTSE 100 and NASDAQ. The service supports exchange-traded funds (ETFs), forex pairs, and contracts for difference (CFDs). Thirteen currencies are supported for deposits and withdrawals, simplifying international transactions.

| Asset Type | Examples | Key Benefit |

|---|---|---|

| Stocks | Apple, Tesla, Unilever | Fractional share investing |

| Forex | GBP/USD, EUR/JPY | Leverage up to 1:30 |

| ETFs | Vanguard S&P 500 | Low expense ratios |

User Experience on Mobile and Web Platforms

The mobile app features real-time price alerts and customisable watchlists. Charts display 15-minute delays for free users, while premium subscribers get instant updates. Both web and mobile interfaces use colour-coded menus to streamline navigation.

Advanced tools like stop-loss orders integrate seamlessly across devices. You can manage your account while commuting or at home without compromising functionality. This dual-platform approach ensures your strategies adapt to your lifestyle.

Trading212 Card: Features, Fees and Cashback

Combining everyday purchases with investment opportunities reshapes how you handle finances. The debit card links directly to your uninvested funds, letting you spend while keeping money ready for trading. This setup removes the need to transfer cash between accounts, saving time and effort.

Rewards and Currency Conversion Details

Earn 0.5% cashback on all purchases, automatically credited to your account. For a limited period, you can boost rewards to 1.5% by reinvesting them into shares or ETFs. Monthly rewards cap at £20 until June 2025, then reduce to £15.

| Feature | Detail | Benefit |

|---|---|---|

| Cashback Rate | 0.5% standard / 1.5% reinvested | Boost returns on daily spending |

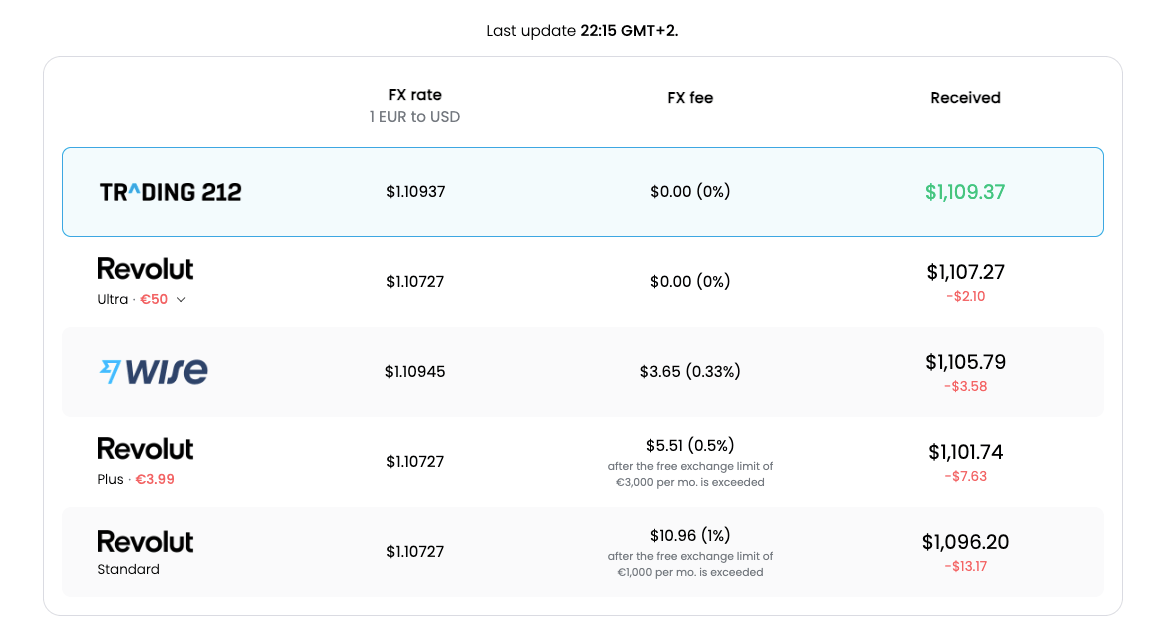

| FX Fee | 0.15% per transaction | No weekend surcharges |

| Spending Limits | £5k daily / £15k monthly | Controlled access to funds |

Costs and Access Options

Ordering a physical card costs £4.95, while the virtual version integrates with mobile wallets at no charge. Both options use Mastercard’s exchange rates, often better than high-street banks. No monthly fees apply, and ATM withdrawals remain free within usage limits.

Funds come directly from your investment account’s cash reserve, ensuring seamless access. Track spending and adjust budgets through the app’s real-time dashboard. Transparent pricing helps avoid unexpected charges, making it easier to plan purchases.

Analysis of Pros and Cons

Balancing investment goals with daily expenses requires innovative solutions. This hybrid approach merges market participation with practical spending tools, but like any financial product, it has trade-offs worth considering.

Advantages for UK Investors

The platform’s cashback scheme stands out, offering up to 1.5% rewards when reinvested. You earn returns on uninvested cash through competitive interest rates, a rare feature among investment accounts. Zero commission trading across shares and ETFs keeps costs predictable, ideal for frequent traders.

Users praise the app’s real-time tracking, which simplifies managing both portfolios and purchases. Over 90% of reviews highlight the convenience of fee-free overseas spending, particularly useful for travellers. Integration with mobile wallets adds flexibility for contactless payments.

Limitations and Potential Drawbacks

Separating funds for spending and investing requires manual transfers, which some find cumbersome. Unlike traditional banks, the service lacks direct debits or standing orders, limiting bill payments. While customer support scores highly, response times vary during peak hours.

Alternatives like American Express offer higher cashback rates but lack integrated trading features. The spending pot’s £5k daily limit may frustrate larger purchases. Though FSCS-protected, it shouldn’t replace your primary current account due to these functional gaps.

Regulation, Security and Compliance

Financial security remains paramount when managing both investments and daily spending. Platforms merging these functions must adhere to rigorous standards to protect users’ assets and personal data. This section examines the safeguards ensuring your money remains secure while balancing market participation with everyday transactions.

FSCS Protection and Security Measures

Your uninvested cash receives protection under the Financial Services Compensation Scheme (FSCS). This covers up to £85,000 per person if the provider fails, matching protections offered by UK high-street banks. Funds allocated to investments fall under separate safeguarding rules through segregated client accounts.

| Security Feature | Description | Benefit |

|---|---|---|

| FSCS Coverage | £85,000 deposit protection | Equivalent to traditional banking |

| Two-Factor Authentication | Mandatory for logins & transactions | Blocks unauthorised access |

| Fund Segregation | Separates spending/investment pots | Prevents accidental misuse |

Advanced encryption secures all transactions and personal details. The platform uses TLS 1.2 protocols, matching security levels seen in online banking. Spending money stays isolated from market positions, reducing operational risks.

Regulatory Oversight and Compliance Standards

Trading212 UK Ltd operates under Financial Conduct Authority (FCA) supervision, ensuring adherence to capital adequacy and client fund rules. Its European entity follows Cyprus Securities and Exchange Commission (CySEC) guidelines, providing additional oversight for international users.

Regular audits verify compliance with anti-money laundering (AML) directives. Over 87% of user reviews praise the transparent fee structure and responsive customer support team. This dual-layer regulation fosters trust in how your account operates across borders.

Ideal User Profile for UK Traders

Merging your financial activities into one streamlined system could revolutionise how you manage money. This hybrid approach particularly suits those who want their spending habits and investment strategies to work in tandem. Let’s explore which groups gain the most from this dual-purpose solution.

Who Benefits Most?

This service shines for UK-based individuals who:

- Prefer managing investments and daily expenses through a single app

- Value commission-free trades alongside cashback rewards

- Frequently make international purchases without hidden fees

New investors appreciate the intuitive interface for building portfolios while accessing uninvested funds. Active traders benefit from real-time adjustments to positions alongside everyday spending. The automatic cashback reinvestment feature particularly appeals to those prioritising long-term growth.

Tech-savvy users will enjoy mobile-first account management. Instant notifications for transactions and market movements keep you informed without switching platforms. Separating funds into spending and investing pots suits meticulous planners who dislike commingling budgets.

Whether you’re starting your financial journey or refining established strategies, this ecosystem adapts to your needs. Its blend of accessibility and advanced tools creates opportunities for diverse money management styles.

Insights into Uninvested Cash Management and Spending Pots

Efficient cash management becomes crucial when balancing market opportunities with daily expenses. The platform’s mandatory spending pot system now separates funds designated for purchases from those ready for trading. This division enhances security while ensuring your money works harder through interest accrual.

How the Spending Pot Operates

Your account automatically splits into two sections: the trading pot for investments and the spending pot for purchases. Cashback rewards land directly in the spending pot, while uninvested cash in the trading pot earns competitive interest rates. Moving money between pots takes three taps in the app – no paperwork or delays.

Security improves as proceeds from sold shares remain in the trading pot until manually transferred. This prevents accidental spending of investment capital. The system also blocks instant access to recently deposited funds, adding a protective buffer against impulsive decisions.

Balancing Financial Priorities

Interest accrues daily on trading pot balances, incentivising you to keep funds there until needed. When making purchases, only the spending pot’s balance becomes accessible via the linked payment method. Real-time tracking shows exactly how much you’ve allocated to each purpose.

This structure prevents commingling of investment capital with grocery budgets. You maintain growth potential through interest earnings while having liquid funds for emergencies. The separation simplifies tax reporting by clearly distinguishing investment activity from everyday transactions.

Adjusting allocations takes seconds, letting you respond to market movements or unexpected expenses. While the system requires active management, it ultimately provides clearer financial oversight than traditional combined accounts.

Conclusion – Trading212 Card is Worth it?

Juggling market opportunities with everyday finances requires smart tools. The 212 card bridges this gap through its dual-purpose design, letting you trade assets while accessing cash for purchases. With up to 1.5% reinvested cashback and competitive interest on unspent funds, it rewards both strategic investing and routine spending.

Robust security measures like FSCS protection and two-factor authentication mirror traditional banking standards. Transparent fees – including no monthly charges – make budgeting predictable. However, manual fund transfers between pots and spending limits may challenge those needing seamless liquidity.

This solution suits UK traders who prioritise integrated money management. If you value real-time tracking of investments alongside debit card purchases, it’s worth exploring. Consider your financial strategy: does blending market access with daily spending align with your goals? For many modern investors, this hybrid approach could redefine how money works harder across all fronts.