Starting your journey in the stock market can feel overwhelming, but platforms like Trading212 simplify the process for UK investors. Known for its intuitive interface and commitment to accessibility, Trading212 allows you to purchase shares, ETFs, and other assets with minimal fuss. Whether you’re building a long-term portfolio or exploring short-term opportunities, the platform caters to diverse investment goals.

One standout feature is its tax-efficient Individual Savings Account (ISA), which shields your profits from capital gains tax. Alongside this, the Fund and Share Account offers flexibility for those with larger portfolios. Choosing the right account type ensures your money grows efficiently while adhering to UK financial regulations.

Trading212 operates under strict Financial Conduct Authority (FCA) guidelines, providing a secure environment for your investments. With no commission fees on trades and a transparent fee structure, it’s designed to keep costs predictable. This makes it particularly appealing for newcomers who want clarity on expenses.

This guide walks you through opening an account, navigating the platform, and executing your first trade. You’ll also learn how to diversify your holdings and monitor performance. By the end, you’ll have the tools to make informed decisions and build a resilient investment strategy.

An Introduction to Trading212 and Its Appeal for UK Investors

Trading212 has emerged as a top choice for UK investors due to its innovative tools and transparent approach. The platform combines intuitive design with powerful features, making it ideal for both newcomers and seasoned traders. Its mobile and web interfaces prioritise ease of use without compromising on functionality.

Overview of the Trading212 Platform

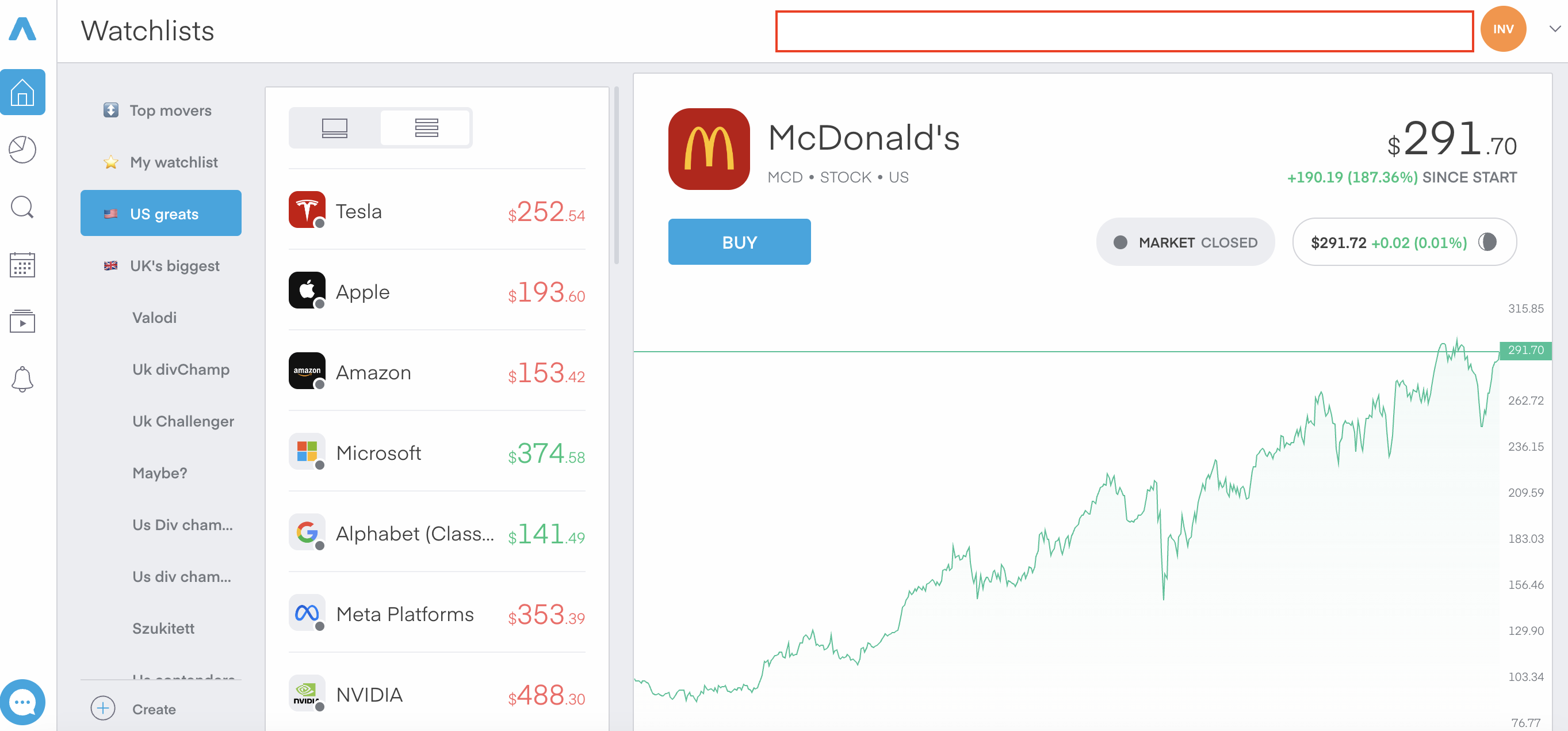

The platform’s clean layout allows you to execute trades swiftly, monitor portfolios, and access real-time data. Interactive charts and customisable watchlists help streamline decision-making. Unlike many competitors, Trading212 integrates educational resources directly into its interface, fostering informed strategies.

Below is a comparison of Trading212’s standout features against other UK brokers:

| Feature | Trading212 | Average UK Broker |

|---|---|---|

| Commission Fees | £0 on shares/ETFs | Up to £10 per trade |

| Research Tools | Advanced analytics + news feeds | Basic charts only |

| FCA Regulation | Full compliance | Varies by provider |

Why UK Investors Choose Trading212

Transparent pricing structures ensure you retain more of your money. There are no hidden charges for deposits, withdrawals, or account maintenance. This clarity appeals to investors focused on long-term growth.

Robust research tools, including earnings reports and sector analyses, empower you to evaluate shares confidently. Combined with FCA-backed security measures, the platform safeguards your investments while offering competitive flexibility.

Trading212’s Main Features and Supported Assets

Trading212 equips you with a versatile toolkit to explore global markets efficiently. Whether you prefer traditional shares or niche instruments, the platform supports multiple asset classes under one roof. This flexibility caters to varying risk appetites and financial objectives.

Diverse Investment Options: Stocks, ETFs, Forex and More

You’ll find over 10,000 instruments spanning equities, exchange-traded funds (ETFs), and forex pairs. Company shares from giants like Apple and Tesla sit alongside niche funds tracking renewable energy or AI trends. The platform also offers fractional shares, letting you invest in high-value assets with modest budgets.

| Asset Type | Examples | Key Features |

|---|---|---|

| Stocks | UK-listed firms, US tech companies | Fractional ownership, dividend reinvestment |

| ETFs | Vanguard S&P 500, iShares Clean Energy | Low-cost diversification, automatic rebalancing |

| Forex | GBP/USD, EUR/JPY | Leverage options, 24/5 trading |

Additional Instrument Offerings and Tools

Beyond core assets, Trading212 provides real-time market data and interactive charting tools. These help you analyse trends without switching platforms. Customisable watchlists track your favourite funds alongside price alerts for timely decisions.

The platform supports multiple order types, including stop-loss and limit orders. This gives you precise control over entry and exit points. Whether you’re building a long-term portfolio or exploring short-term opportunities, these features streamline the process.

User Experience: Mobile and Web Platforms

Effortless accessibility defines Trading212’s approach to modern investing. Its mobile app and web platform sync seamlessly, letting you manage investments across devices without missing market movements. Whether adjusting portfolios on a commute or analysing trends at home, the experience remains consistent and intuitive.

Intuitive Interface and Navigation

The mobile app prioritises clarity, with a dashboard that displays your accounts, watchlists, and pending orders in one glance. Customisable menus let you hide rarely used tools, reducing clutter. On the web version, drag-and-drop widgets allow personalised layouts tailored to your strategy.

| Feature | Mobile App | Web Platform |

|---|---|---|

| Interface Design | Simplified menus | Customisable widgets |

| Account Management | Single login for multiple accounts | Advanced portfolio analytics |

| Order Execution | One-tap trade placement | Multi-step order previews |

| Data Accessibility | Real-time price alerts | Full-screen charting tools |

Interactive Tools and Real-Time Data

Real-time feeds update every 15 seconds across both platforms, ensuring you base decisions on current market conditions. Price alerts notify you instantly when assets hit target levels. Orders execute in minutes, whether you’re setting up recurring investments or adjusting stop-loss limits.

The process from login to trade confirmation is streamlined. Beginners benefit from guided tutorials embedded within the interface, while experienced users appreciate time-saving shortcuts like template-based order setups. This balance keeps the platform adaptable to diverse skill levels.

Fees, Commissions and Account Options

Understanding costs and account structures is essential for maximising returns. Trading212 maintains transparency with no commission fees on share or ETF trades. This approach keeps expenses predictable, whether you’re placing frequent orders or building positions gradually.

Understanding Charges and Cost Structures

The platform avoids hidden fees for deposits, withdrawals, or account maintenance. Currency conversion charges apply when dealing with international shares, typically 0.15% per transaction. Regular investors benefit from no inactivity fees, making it cost-effective for long-term strategies.

| Account Type | Tax Benefits | Annual Allowance | Fees |

|---|---|---|---|

| Stocks & Shares ISA | Tax-free profits up to £20,000 | £20,000 | £0 management fees |

| Fund & Share Account | No capital gains tax allowance | Unlimited | 0.5% FX fee above £2,000 |

Investment Account Types and Their Benefits

The Stocks & Shares ISA shields your gains from income and capital gains tax. This makes it ideal for UK residents prioritising tax efficiency. You can buy shares in global companies without worrying about annual tax filings on profits below the allowance.

The Fund & Share Account suits those exceeding ISA limits or holding non-eligible assets. While taxable, it offers flexibility for larger portfolios. Both accounts let you buy and sell assets instantly through the same intuitive interface.

Regulation, Security and Trustworthiness

Trust forms the foundation of any successful investment strategy, and Trading212 prioritises this through rigorous regulatory compliance. Your assets and personal data benefit from multilayered safeguards designed to meet UK financial standards. This combination of oversight and technology ensures your investments remain protected at every step.

Compliance With FCA Standards

Trading212 operates under full Financial Conduct Authority (FCA) authorisation (reference number 609146). This means client funds are held in segregated accounts at tier-1 banks, separate from company assets. Should unforeseen issues arise, the Financial Services Compensation Scheme covers up to £85,000 per eligible claim.

The platform undergoes regular audits to verify adherence to capital adequacy rules. These measures ensure it maintains sufficient reserves to honour withdrawal requests, even during market volatility. Such transparency builds confidence in how your investments are managed.

Security Measures for Your Investments

Advanced encryption protocols protect your information during exchanges and transactions. Two-factor authentication adds an extra step when accessing accounts or confirming trades. Over 15 distinct security protocols monitor for suspicious activity 24/7.

Currency conversions use real-time rates with no hidden markups, reducing exposure to exchange risks. Automated systems also flag irregular login attempts, prompting immediate verification checks. By prioritising information security, Trading212 lets you focus on strategy rather than concerns about data breaches.

Pros and Cons of Trading212 for Your Investment Journey – How to Buy Stocks

Every investment platform involves trade-offs. Trading212 combines user-friendly design with robust tools, but understanding its limitations helps you make strategic decisions. Let’s examine what works well and where cautious planning becomes essential.

Strengths of the Platform

Trading212 excels in three areas:

- Cost efficiency: Zero commission on share/ETF trades keeps expenses low, boosting potential returns.

- Fractional investing: Build a diversified portfolio with small amounts, spreading risk across assets.

- Educational integration: Real-time tutorials and market analysis tools help refine your strategy.

User reviews frequently praise the platform’s responsive design. Over 78% of Trustpilot ratings (4.5/5 stars) highlight its intuitive order execution and tax-efficient ISA options.

Areas for Improvement to Consider

While powerful, the platform has constraints:

- Limited advanced tools: Lacks in-depth technical indicators favoured by professional traders.

- Currency charges: FX fees apply to international trades, slightly reducing growth potential.

| Aspect | Strength | Consideration |

|---|---|---|

| Risk Management | Stop-loss orders available | No guaranteed stop protections |

| Asset Diversity | 10,000+ instruments | No mutual funds |

Balancing risk and reward remains crucial. Diversify across sectors, set realistic return expectations, and review your portfolio quarterly. Market fluctuations demand flexibility – consider drip-feeding investments rather than lump sums.

The Step-by-Step Process: hot to buy stocks on Trading212

Executing trades on Trading212 follows a streamlined process designed for clarity and speed. You’ll need to complete three core actions: account setup, funding, and order placement. Each step integrates safeguards to protect your funds while maintaining efficiency.

Setting Up and Funding Your Account

Begin by downloading the Trading212 app or visiting their website. Select ‘Create Account’ and provide basic personal details. The platform requires identity verification under FCA rules – upload a passport scan and recent utility bill.

Once approved, navigate to ‘Deposit Funds’. Choose from bank transfers, debit cards, or digital wallets like PayPal. Transfers typically clear within one business day. For security, enable two-factor authentication before adding money.

Placing Trades and Managing Your Portfolio

Search for your chosen asset using the ticker symbol or company name. Check live share prices directly on the order screen. You’ll need to decide between market orders (instant execution) or limit orders (set your desired price).

After confirming the trade, monitor positions via the portfolio dashboard. Set price alerts to track fluctuations without constant manual checks. Diversify holdings across sectors to balance risk – this strategy helps weather market shifts.

Determining If Trading212 Is Right for You

Selecting an investment platform depends on how well its features align with your financial objectives. Trading212 offers distinct advantages, but assessing your priorities ensures it complements your strategy. Let’s explore key factors to consider.

Identifying Your Investment Profile

Begin by evaluating your risk tolerance and time horizon. Are you building wealth gradually through stable companies, or seeking rapid growth in volatile sectors? Trading212’s fractional shares and ISA options suit cautious investors who want to invest incrementally.

Active traders benefit from real-time alerts and diverse order types. However, those requiring advanced technical analysis might find the tools limited. The platform shines for hands-on investors comfortable managing their own fund allocations across global markets.

The Advantages for UK-Based Investors

UK residents gain specific benefits from Trading212’s structure. The Stocks & Shares ISA shelters up to £20,000 annually from capital gains tax – ideal if you’re comfortable with long-term holdings. Over 4,000 companies and 300 ETFs provide ample diversification opportunities.

Compared to traditional brokers, the platform simplifies accessing international markets. You can invest shares from US tech giants alongside UK-focused funds without excessive fees. Regular deposits automate portfolio growth, particularly useful if you want to invest consistently.

Security remains paramount. FCA oversight and segregated client accounts ensure your money stays protected. Whether targeting established companies or niche funds, Trading212 balances accessibility with robust safeguards.

How to Buy Stocks – Conclusion

Navigating the stock market becomes manageable with platforms designed for clarity and efficiency. Trading212 UK stands out by combining simplicity with robust tools, helping you hold shares in leading companies without complexity. Its tax-efficient ISA and commission-free trades add tangible value to your investment journey.

The platform’s security measures, including FCA regulation and segregated accounts, ensure your funds remain protected. Competitive fees and real-time analytics further enhance its appeal. By following the step-by-step process outlined in this guide, you can align your actions with long-term financial goals.

Trading212’s user-friendly interface demystifies investing, whether you’re building a diversified portfolio or exploring individual opportunities. It offers a practical way to participate in global markets while maintaining control over your strategy.

For those seeking a reliable method to hold shares and grow wealth, Trading212 delivers accessibility and trust. Consider exploring its features to discover how it supports your unique approach to achieving investment goals.