Navigating share purchases requires a reliable platform and clear strategy. This guide explains Trading212’s role in helping UK investors access global markets, focusing on Amazon shares. You’ll learn about account setup, fee structures, and risk management tailored to British financial regulations.

Trading212 stands out for its user-friendly interface and diverse asset classes, including stocks, ETFs, and forex. The platform charges no commission on equity trades, though currency conversion fees apply for US dollar-denominated investments like Amazon. UK investors benefit from Financial Conduct Authority (FCA) protection, safeguarding funds up to £85,000.

Understanding market risks remains crucial. Share prices fluctuate based on company performance and economic factors, potentially affecting your portfolio’s value. Currency exchange rates add another layer of complexity, impacting returns when trading internationally listed shares.

This guide prioritises transparency. You’ll find current details on Trading212’s fee policies, tax considerations for dividends, and strategies to balance risk. Always assess your financial goals and consult independent professional advice before committing funds.

Why Choose Trading212 for Your Investments

Selecting the right investment platform shapes your financial journey. Trading212 combines diverse asset access with cost efficiency, appealing to those building long-term portfolios. Its blend of functionality and regulatory safeguards meets the needs of modern investors.

Main Features and Supported Assets

Trading212 offers 10,000+ global instruments across three core categories:

| Asset Class | Key Benefits | Examples |

|---|---|---|

| Stocks | Direct ownership in companies | UK/US equities |

| ETFs | Diversified exposure | Index trackers |

| Forex | Currency pair trading | GBP/USD |

Commission-free share dealing keeps costs predictable. A 0.15% FX fee applies to dollar-denominated assets, lower than many UK competitors. Unlike Hargreaves Lansdown’s £11.95 equity charge, this model benefits frequent traders.

Buy Amazon shares on Trading212

Why It Appeals to UK Investors

FCA regulation ensures client funds sit in segregated accounts with £85,000 protection. The platform’s intuitive design simplifies portfolio management across devices. Real-time pricing and risk warnings help you make informed decisions.

Low entry thresholds let you start with small amounts while managing capital risk. These factors create an accessible environment for both new and experienced investors prioritising value retention.

How to Buy Amazon Stocks

Acquiring shares in global companies demands careful execution and platform familiarity. This section clarifies the practical steps for establishing your Trading212 presence and completing transactions securely.

Step-by-Step Account Setup

Begin by registering via the Trading212 website or app. Provide your full name, contact details, and tax residency information. Authorised UK residents must submit proof of identity, such as a passport scan or driving licence.

Fund your account using a debit card or bank transfer. Deposits in pounds sterling automatically convert to dollars for US-listed shares, incurring a 0.15% FX fee. Verify your payment method to activate trading privileges.

Placing Your Order on Trading212

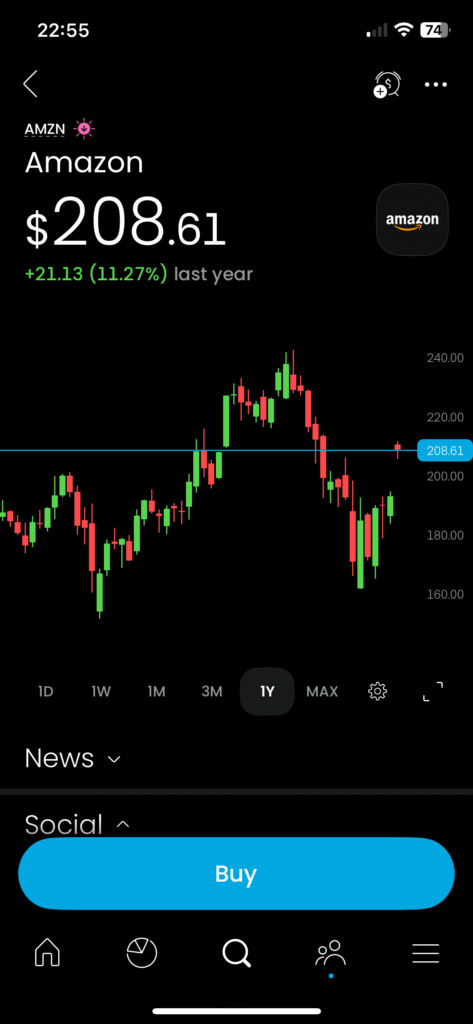

Search “AMZN” in the platform’s instrument panel. Review Amazon’s current stock price and historical performance data. Specify either share quantity or monetary amount for fractional investments.

Choose between market orders (instant execution) or limit orders (price thresholds). Transactions process during NYSE hours (14:30–21:00 GMT). Orders placed post-market queue for next-day opening.

Always verify entries before confirming trades. Mispriced limits or incorrect share counts could impact returns. Monitor positions through your portfolio dashboard post-purchase.

Buy Amazon shares on Trading212

Fees, Commissions and Currency Conversion Considerations

Cost management separates successful investors from those who erode returns through avoidable charges. Trading212’s fee model prioritises transparency, but currency conversions and competitor comparisons require scrutiny.

Understanding Trading Fees and FX Charges

Equity trades carry no commission, though US share purchases involve a 0.15% FX fee. This applies when converting pounds to dollars. Holding a USD balance reduces repeated conversion costs for frequent traders.

| Broker | Equity Commission | FX Fee | Platform Fee |

|---|---|---|---|

| Trading212 | £0 | 0.15% | £0 |

| Hargreaves Lansdown | £11.95 | 1.00% | £45/year |

| Interactive Investor | £5.99 | 1.50% | £119.88/year |

Currency fluctuations add capital risk. A 5% GBP/USD shift could erase gains from 33+ Amazon share purchases at Trading212’s rates.

Comparing Commission Structures

Annual costs matter. Investing £5,000 across 10 trades incurs £0 with Trading212 versus £119.50 elsewhere. Small fees compound: 2% annual charges could consume 40% of returns over 30 years.

Strategies to preserve capital:

- Bundle trades to minimise FX fees

- Monitor GBP/USD rates for optimal conversions

- Use limit orders to control execution prices

Always review fee disclosures before committing funds. Tax treatments vary for dividends and capital gains – consult HMRC guidelines for clarity.

User Experience on Mobile and Web Platforms

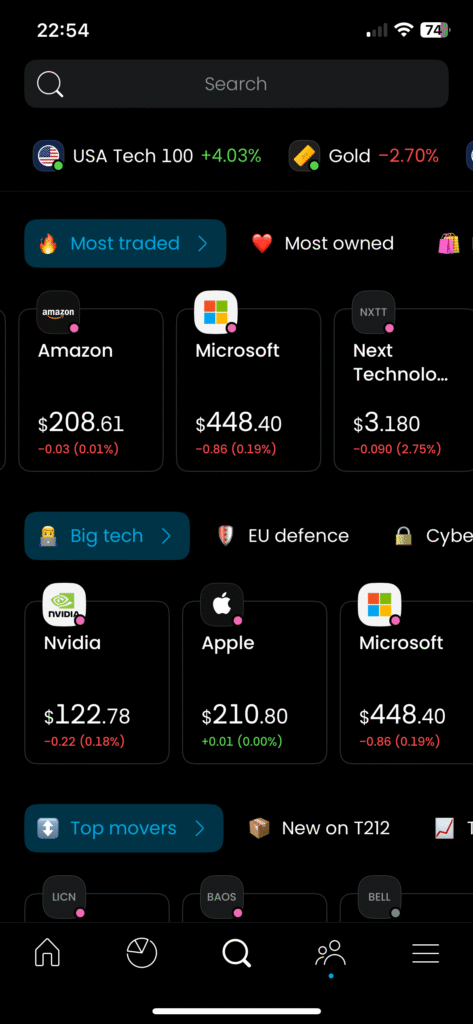

Modern investment platforms thrive on accessibility and functionality. Trading212 delivers a streamlined experience across devices, letting you manage positions with minimal friction. Whether checking your portfolio during commutes or analysing trends from a desktop, the interface adapts to your needs.

Interface and Usability Overview

Trading212’s design prioritises clarity. A collapsible sidebar organises markets, watchlists, and account details. Colour-coded price charts and real-time updates create an at-a-glance overview of your investments. Users report sub-second order execution speeds during peak trading hours.

| Platform | Key Features | Customisation |

|---|---|---|

| Mobile App | One-tap orders, biometric login | 6 chart types, 8 indicators |

| Web Version | Multi-screen layouts, advanced filters | 20+ technical analysis tools |

Tools and Resources for Investors

Built-in performance trackers measure returns against major indices like the S&P 500. News feeds aggregate updates from Bloomberg and Reuters, filtered by your holdings. Risk management features include price alerts and loss thresholds for individual positions.

Both platforms offer educational content explaining market concepts. Video tutorials cover topics from dividend reinvestment to sector diversification. These resources help you make informed decisions without leaving the app.

Regulation, Security and Investor Protection

Financial security forms the foundation of trustworthy investing. Trading212 operates under strict oversight from the Financial Conduct Authority (FCA), ensuring your activities align with UK regulatory standards. This framework prioritises transparency while managing exposure to market fluctuations and currency risks.

FCA Regulation and Compliance

The FCA requires segregated client accounts, separating your funds from company assets. This prevents misuse and guarantees access to the Financial Services Compensation Scheme (FSCS). Should Trading212 face insolvency, you’re protected for up to £85,000.

Regular audits assess platform practices, from fee disclosures to risk warnings. Tax-efficient accounts like ISAs receive specific guidance, helping you navigate dividend reporting. These measures reduce capital risk while maintaining compliance with anti-money laundering rules.

Safety Measures and Data Security

Advanced encryption (AES-256) safeguards personal and financial information during transactions. Two-factor authentication adds an extra layer for account access. Security teams conduct penetration testing to identify vulnerabilities before exploitation.

Investor protection extends to educational content explaining market volatility. Real-time alerts notify you of significant price movements affecting holdings. Always verify a broker’s regulatory status through the FCA register before committing funds.

Consult independent financial advisers when assessing complex investments. Regulatory supervision alone cannot eliminate risks, but it creates accountability missing in unregulated markets.

Pros, Cons and Who Trading212 is Best Suited For

Evaluating investment platforms requires understanding their strengths and limitations. Trading212’s blend of accessibility and cost-efficiency appeals to specific investor profiles, though certain risks demand careful assessment.

Advantages for Various Investor Types

Three groups benefit most from this platform:

- Novices: No minimum deposit and intuitive tools simplify early-stage investing

- Cost-focused traders: 0% commission on shares outperforms Hargreaves Lansdown’s £11.95 per trade

- Diversification seekers: Access 10,000+ instruments including fractional shares

| Feature | Trading212 | Hargreaves Lansdown |

|---|---|---|

| Equity Fees | £0 | £11.95/trade |

| FX Charges | 0.15% | 1.00% |

| Account Minimum | £1 | £100 |

Considerations and Potential Drawbacks

Market volatility remains unavoidable. Share prices can swing 5% daily, potentially eroding capital. Currency conversions add complexity – a weak pound reduces dollar-based returns.

While no hidden fees exist, three factors impact returns:

- 0.15% FX charge on US-listed shares

- No direct access to IPOs or corporate bonds

- Limited research tools versus traditional brokers

FCA protection safeguards your money, but investments can still lose value. Those requiring advanced trading features might prefer platforms with deeper analytics.

Ultimately, Trading212 suits investors prioritising low costs and simplicity. Assess your risk tolerance and portfolio goals before committing funds. Regular portfolio reviews help manage exposure to market shifts.

How to Buy Amazon Stocks and Shares – Conclusion

Building a diversified portfolio requires strategic platform selection and market awareness. Trading212 simplifies purchasing US-listed shares through its streamlined account setup and fractional trading options. Verify your identity, fund your account, and execute orders during NYSE hours while monitoring currency conversion fees.

The platform’s strengths lie in its FCA-regulated environment and cost-efficient structure. Competitive FX charges and zero equity commissions help preserve your investment’s value across multiple trades. Real-time tools and segregated client accounts provide transparency in volatile markets.

Market fluctuations and exchange rate risks remain inherent in global share trading. Tax implications on dividends and capital gains demand careful planning. Always cross-check current broker information, as regulations and fee structures evolve.

Review your financial objectives against these insights before committing funds. Consult independent advisers to address complex scenarios. Informed decisions grounded in reliable content position investors to navigate dynamic markets effectively.

Buy Amazon shares on Trading212